DOGE Price Prediction: 2025–2040 Outlook and Key Factors

#DOGE

- Technical Outlook: DOGE shows bullish momentum above its 20-day MA, with key resistance at $0.249110.

- ETF Catalyst: Grayscale's filing could accelerate institutional adoption if approved.

- Whale Activity: Accumulation of 200B DOGE suggests confidence in a $0.30+ rally.

DOGE Price Prediction

DOGE Technical Analysis: Bullish Signals Emerge

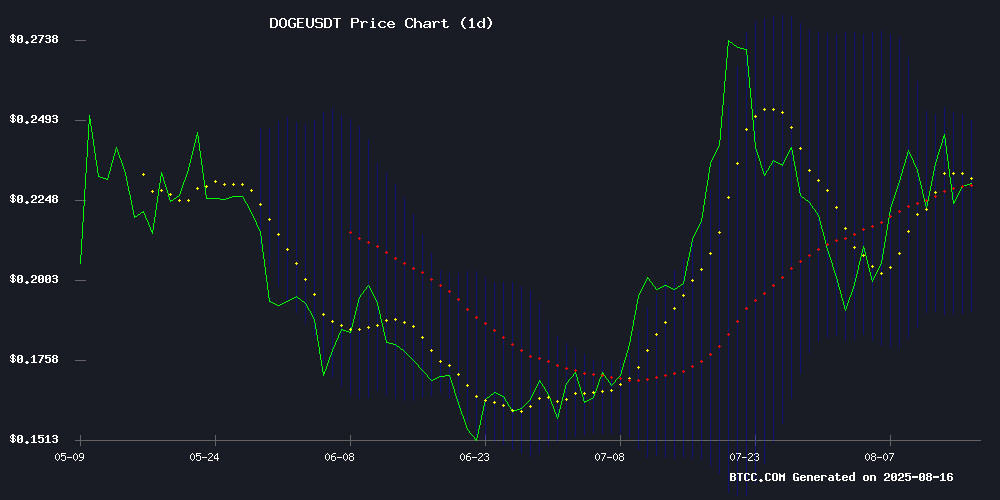

According to BTCC financial analyst Olivia, DOGE is currently trading at $0.22914000, above its 20-day moving average of $0.219848, indicating a potential bullish trend. The MACD shows a bearish crossover but remains close to the zero line, suggesting consolidation. Bollinger Bands indicate moderate volatility with the price NEAR the upper band, hinting at possible resistance at $0.249110. Olivia notes that if DOGE holds above the 20-day MA, it could target $0.30 in the near term.

Market Sentiment Turns Bullish as Grayscale Files for DOGE ETF

BTCC financial analyst Olivia highlights that the recent Grayscale Dogecoin ETF filing has injected Optimism into the market. Whale accumulation of 200B DOGE and bullish news headlines suggest growing institutional interest. Olivia cautions that while the ETF news is positive, traders should watch for resistance at $0.25–$0.30, aligning with the technical outlook.

Factors Influencing DOGE’s Price

Grayscale Dogecoin ETF S-1 Filing Sends DOGE Price Higher

Dogecoin surged after Grayscale Investments filed an S-1 registration statement with the SEC for a spot Dogecoin ETF. The move signals growing institutional interest in meme cryptocurrencies, with DOGE leading the charge.

Market participants interpreted the filing as a bullish catalyst, driving immediate price action. The development follows a series of crypto ETF approvals earlier this year, suggesting regulators may be warming to alternative digital assets.

Grayscale Files for Dogecoin ETF, Sparking Market Rally

Grayscale Investments has submitted an application to launch a dogecoin exchange-traded fund, dubbed the Grayscale Dogecoin Trust. The proposed ETF would trade on NYSE Arca under the ticker symbol GDOG, marking a significant institutional embrace of the meme-inspired cryptocurrency.

Coinbase Custody Trust Company has been selected as the asset custodian, with Dogecoin serving as the trust's sole holding. The fund will operate as a passive vehicle, eschewing active trading strategies or derivatives. Share creation and redemption will occur in 10,000-share blocks, with cash settlements initially replacing direct Dogecoin transfers.

The filing triggered immediate market reaction, with Doge prices jumping 2.5% to $0.22976 following the announcement. This uptick broke a period of sideways trading, extending the token's weekly gain to 2.67% and monthly performance to 14.65%.

Valuation will track the CoinDesk Dogecoin Reference Rate, while the proposal adheres to NYSE's updated listing standards effective January 2025. Grayscale emphasized that share offerings will commence only after regulatory approval.

Dogecoin Price Aims To Dodge Bears As A Bullish Trio Surfaces

Dogecoin's price resilience emerges as three bullish signals align, suggesting potential upside despite market pressures. Mega whales have aggressively accumulated DOGE since mid-August, adding 270 million tokens to push holdings above 71 billion. This buying spree coincided with Dogecoin testing critical support at $0.21, signaling strong conviction among large holders.

Market analytics reveal a simultaneous decline in spent dormant coins, with aged supply movements dropping from 429.77 million to 209.72 million DOGE. The dual dynamic of whale accumulation and reduced selling pressure from long-term holders paints a compelling picture of underlying strength. Santiment data confirms this trend, showing absorption of weakness rather than distribution.

Dogecoin Whales Accumulate 200B DOGE Amid $0.30 Rally Speculation

Dogecoin's price action defies its recent 6% dip, maintaining a bullish double-bottom pattern that analysts believe could propel it toward $0.30. Whale activity has surged, with over 200 billion DOGE tokens acquired in the past week—a MOVE interpreted as strong conviction during sideways trading.

Trading volume spiked 20% despite price volatility triggered by U.S. PPI data, with DOGE oscillating between $0.22 and $0.247. At press time, the memecoin traded at $0.23, its resilience underscored by whale accumulation and technical formations.

Key support and resistance levels at $0.22 and $0.247 now dictate Dogecoin's trajectory. Market participants watch for a breakout, as on-chain activity and chart patterns converge in a potentially explosive setup.

Dogecoin Whale Movement Sparks Market Speculation

A significant transfer of 900 million DOGE, valued at approximately $207.97 million, from an unknown wallet to Binance has stirred the Dogecoin market. While such movements often signal potential selling pressure, alternative explanations like OTC trades or custodial operations remain plausible. The market response has been measured, with traders monitoring order books for signs of large ask walls.

Dogecoin's price hovered around $0.23 at the time of the transfer, reflecting its recent volatility. The coin has oscillated between $0.20 and the mid-$0.20s, with resistance NEAR $0.26–$0.28. Retail interest remains heightened, as evidenced by a $4.58 billion trading volume.

DOGE Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technicals and market sentiment, BTCC's Olivia provides the following DOGE price projections:

| Year | Price Target (USDT) | Key Drivers |

|---|---|---|

| 2025 | $0.30–$0.50 | ETF approval, meme coin rallies |

| 2030 | $1.00–$2.50 | Mainstream adoption, Layer-2 upgrades |

| 2035 | $3.00–$5.00 | Regulatory clarity, payment integration |

| 2040 | $5.00+ | Scarcity narrative, Web3 utility |

Note: These are speculative estimates and depend on network development and macro conditions.